How to Register for Asaan Karobar Card Scheme 2025

The Punjab government has launched the Asaan Karobar Card Scheme. In this program, financial assistance up to interest-free loans will be distributed to businesses so that they can further improve their Asaan Karobar Card Scheme

. This scheme is an excellent opportunity for entrepreneurs living in Punjab to improve their economic development and prioritize good business.

Through this Asaan Karobar Card Scheme, loans of around one lakh to 30 million will be provided without any interest and this scheme aims to make a complete effort to help these people live a better and prosperous life

Also Read: Punjab Laptop Scheme Phase-III Online Registration 2025

Key Features of the Asaan Karobar Card Scheme

The Asaan Karobar Card Scheme stands out as a revolutionary step in financial assistance for aspiring entrepreneurs.

Flexible Repayment Terms

You can repay the loan taken under this program in easy installments over five years

Support for Business Growth

The scheme supports both new startups and existing businesses, helping individuals achieve financial stability and success

Loan Limits and Tenure

Loan amount: 100,000 to 1 million PKR.

Tenure: Three years with revolving credit for 12 months.

Repayment Terms

Equal monthly installments over two years after the grace period.

Grace period: Three months from card issuance.

Usage of Funds

Vendor and supplier payments.

Utility bills, government fees, and taxes.

Cash withdrawal (up to 25% of the limit) for miscellaneous business purposes.

End-User Interest Rate

Completely interest-free (0%).

Read More: CM Punjab Introduces ‘Asaan Karobar Card Scheme’ for Easy Business Loans

Asaan Karobar Card Scheme 2025

| Key Features | Details |

| Maximum Loan Limit | PKR 30 million |

| Interest Rate | 0% |

| Loan Tenure | 5 years |

| Grace Period | 3 months |

| Loan Type | Revolving credit facility |

| Application Process | Online via akc.punjab.gov.pk |

Also Read: Benazir Kafalat Program 2025 Latest Payment of Rs. 13,500 Released

Eligibility Criteria for the Asaan Karobar Card

Also Read About: How to Register For CM Punjab Laptop Scheme 2025

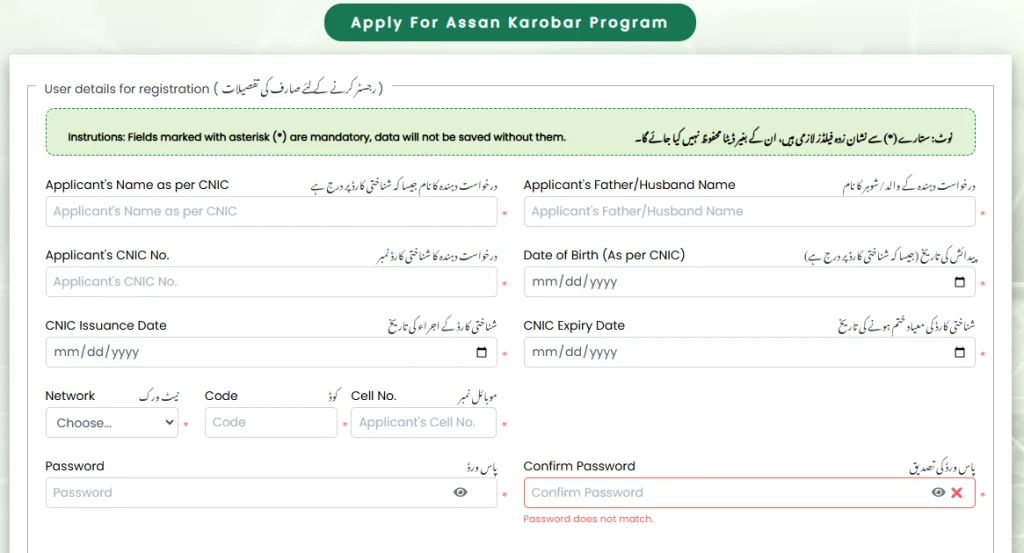

How to Apply for the Asaan Karobar Card Scheme 2025

Read Also:8070 Online Registration Open for Ramazan Ration Program 2025

Fees of the Asaan Karobar Card

- The Asaan Karobar Card comes with minimal charges to ensure affordability for entrepreneurs:

- Annual Card Fee:

- PKR 25,000 + FED, deducted from the approved loan limit.

- Additional Charges:

- Includes life assurance, card issuance, and delivery costs.

- Late Payment Penalty:

- Applied as per the bank’s policy for delayed installments

Conclusion

The Punjab government has launched the Karobar Card Scheme to promote and improve businesses. This program aims to make the lives of these people prosperous and better and to make full efforts to improve their businesses. The meeting also agreed on the ‘Chief Minister Aasan Karabar Financing Scheme’ for medium-level businesses, The loan issued under this scheme will be returnable in five years. The CM Punjab emphasized that these initiatives would create employment opportunities and foster growth in the province’s business and industrial sectors