PM Youth Loan Scheme 2025: Complete details and application procedure

Introduction

To Support the youth of Pakistan and provide employment Chances, the Government of Pakistan has launched the “PM Youth Loan Scheme 2025” or PM Youth Business Loan 2025 details. This scheme provides loans to the youth without any guarantee or Guarantee so that they can start their own business or expand their existing business. In this article, we will present the complete details of this scheme, PM Youth Business Loan 2025 details like eligibility, application procedure, documents and other important information.

What is the PM Youth Loan Scheme 2025?

PM Youth Business Loan 2025 details.

It is a financial scheme that provides loans to the youth of Pakistan to start or expand businesses. Its main objective is to make the youth economically stable and reduce the unemployment rate.

Objectives of the Scheme

- Providing business opportunities to the youth.

- Promoting small and medium enterprises (SMEs).

- Promoting self-employment.

- Increasing the role of youth in economic development.

Scheme Eligibility

PM Youth Business Loan 2025 details.

The following conditions must be met for this loan: PM Youth Business Loan 2025 details. Link “eligibility criteria” to a dedicated page explaining who qualifies for the loan.

Age Limit

- The applicant must be between 18 and 45 years of age.

Nationality

- Only Pakistani citizens can benefit from this scheme.

Educational qualification

- Must have at least matriculated.

- Educational Qualification

- Must be at least matriculated.

Business Plan

- The applicant should have a comprehensive business plan.

Loan History

- If an applicant has previously defaulted on any government loan, he/she will not be eligible for this scheme.

Loan amount and terms

PM Youth Business Loan 2025 details.

Loan Limit

- For new business: Rs. 5 lakh to Rs. 50 lakh.

- For expansion of existing business: Rs. 10 lakh to Rs. 75 lakh.

Interest Rate

Under this scheme, the interest rate has been kept at only 5% per annum, which is much lower than the normal market rate.

Repayment Period

The loan repayment period will be 7 years, including a grace period of 6 months.

Application procedure

Link “step-by-step application procedure” to a detailed guide or section within the same blog post.

PM Youth Business Loan 2025 details.

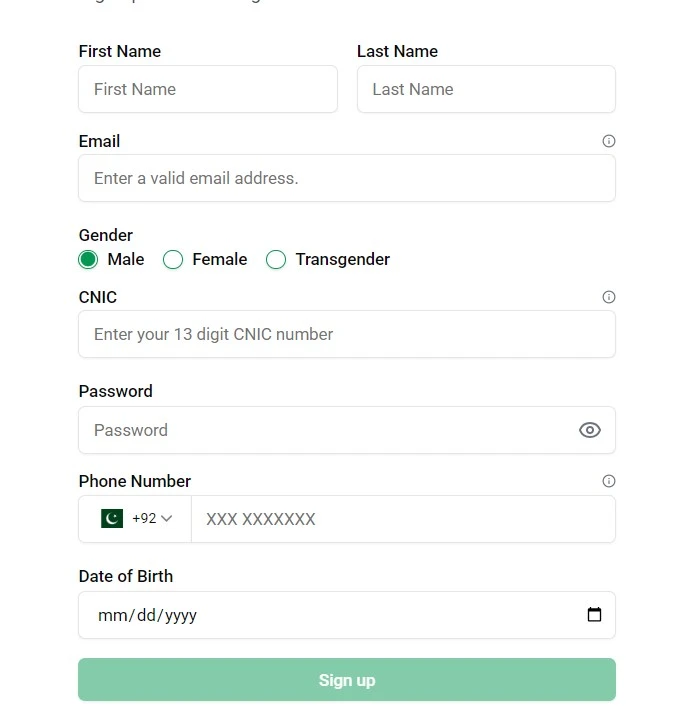

Online Registration

- Visit the official website pmyp.gov.pk.

- Download the application form in the “Youth Loan Scheme 2025” section or fill it online.

- Upload all the required documents.

- A confirmation email or SMS will be received after submitting the application.

Offline Application

- Go to your local Bank of Punjab, National Bank of Pakistan, or And Bank to get the form.

- Submit the form along with the documents.

Required Documents

- Copy of National Identity Card (CNIC)

- Educational Certificates

- Business Plan

- Bank Account Details

- Passport Size Photographs

Approval Process

After submitting your application, a committee will review your business plan. If the plan is viable, the loan will be approved. Approval can take 4 to 6 weeks.

Loan repayment method

- The loan must be repaid in monthly installments.

- An auto-debit scheme is also available through the bank.

- If the loan is not repaid on time, a penalty may be imposed.

Conclusion

The PM Youth Loan Scheme 2025 Purpose as a valuable opportunity for Pakistani young Elders to launch their entrepreneurial ventures. Due to low interest rates and easy terms, this scheme will play a significant role in reducing the financial difficulties of the youth. If you also want to make your dreams a reality, then apply immediately and take advantage of this opportunity.

For more information, contact:

- Helpline: 0800-68888

- Website: https://pmyp.gov.pk

- Email: info@pmyp.gov.pk

- Share this article as much as possible so that more youth can be aware of this scheme.