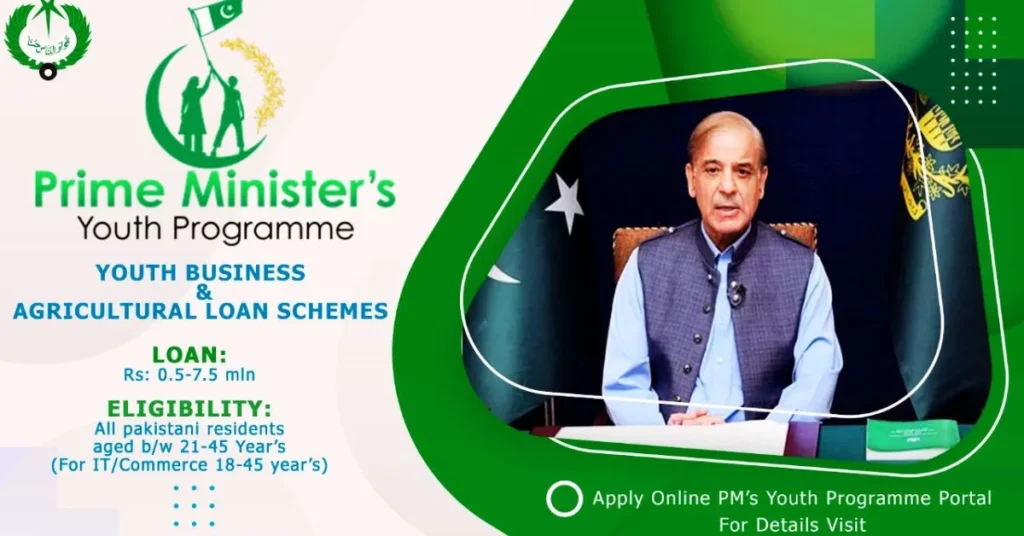

Prime Minister’s Youth Business & Agriculture Loan Scheme Apply Method

In this scheme announced by the Government of Pakistan, a very good plan has been made for the youth of the rural areas of Pakistan, in which the Prime Minister Youth Business & Agriculture Loans Scheme has been launched. Business & Agriculture Loan Scheme with Growth is an excellent opportunity for youth entrepreneurs and farmers to get financial support for their farming and ventures and to improve their future for the younger generation.

The Prime Minister’s Youth Business & Agriculture Loan Scheme promotes internships among youth by providing business loans for low terms and low rates. Through this scheme, youth between the ages of 21 to 45 years can apply for the Prime Ministry Youth Business & Agriculture Loan Scheme. But the loan obtained from this project should be for agriculture or business expansion

Check Eligibility to Business & Agriculture Loan

Before applying to this prime minister scheme, make sure that you fulfill the following criteria

Age: The age limit for applying for this Youth Business & Agriculture Loan scheme is between 21 to 45 years

Citizenship: Being a Pakistani is very important to apply for this scheme

Purpose: The purpose of the loan availed from this project includes agriculture or business development

Visit the Business & Agriculture Loan Scheme Website

To apply for this scheme first visit its official website where you will be provided with the application form and other important details.

Also, Read about the Honhaar scholarship program

Fill Out the Application Form

- Click this button to apply online on the website

- Complete the form with your personal and business details, including:

- Name, CNIC, contact information, and address.

- Business idea or agricultural plan.

- Amount of loan required.

- Double-check your information for accuracy.

Business & Agriculture Scheme Loan Limit

The per borrower/party loan limit for Production Loans under the scheme would range from above Rs. 1.500 million to Rs. 2.500 million.

The per borrower/party loan limit for Development Loans under the scheme would be above Rs. 1.500 million to Rs. 5.000 million.

Collateral

Loans taken under this scheme will be secured against all types of tangible property securities acceptable to the bank, mostly on land in rural areas and on buildings and land in urban areas. In this program, the Prime Minister’s Youth Business & Agriculture Scheme has a powerful outreach to empower the youth across the country, ensuring that no dream goes unfulfilled and to highlight our bright and ambitious youth and a Khushal lays the foundations of Pakistan

Upload Required Documents

You’ll need to upload scanned copies of the following documents:

- CNIC (Computerized National Identity Card).

- Proof of residence.

- Educational or professional certificates (if required).

- Business or agricultural plan.

Submit the Application

Click on the submit Butten

After filling out the form and submitting all the documents you will be given a manual message or email

Follow the Instruction

Save your application number after submitting all documents You can then track your application status through the same portal Wait for the verification process which may include an interview or requests for additional documents

Conclusion

The objective of the Prime Minister Youth Business & Agriculture Loan Scheme is to empower the youth by providing easy access to financial resources to businesses and professionals. Make sure that you meet the criteria. If you do, then you have to fill out the form and upload copies of all the documents, ID card, business proposal, proof of income, and other required details. The latter has become a popular point in which the concerned authority of the bank verifies the application and contacts the applicant for further details or interview or further details are given to them through mail or message.

FAQS

Who is eligible for the youth loan scheme?

All men/women holding CNIC, aged between 21 and 45 years with entrepreneurial potential are eligible.

What is the 5 lakh loan scheme in Pakistan?

Those who wish to get a loan can get a loan from 5 lakhs to 75 lakhs at a low markup after completing their registration.